Since the massive financial crisis that Turkey suffered in 2001, policy changes have dramatically improved welfare and economic performance. Since then, real per capita income has increased by 50 percent, poverty has been more than halved, and extreme poverty has been reduced even more. As a result of welfare improvements, average life expectancy increased by five years, enrollment and graduation rates at all levels of education rose significantly, while gender gaps narrowed. The transformation into an industrial and service economy continued, with agriculture still accounting for over one fifth of total employment. However, the process of Turkey joining the world’s advanced economies slowed after 2008, and its progress has increasingly diverged from the historical record of best performing economies. This was because the pace of reform that had been designed to move Turkey towards European Union membership flagged and economic decisions became increasingly politicized. Economic growth continues to be unbalanced, accompanied by increasing private sector and external debt.

The Turkish economy is also paying the price of the country's deepening political woes. In July 2016, the failed coup was followed by the imposition of a state of emergency. More than 140,000 public sector employees, including one fifth of all judges and prosecutors and over one third of the staff of the banking supervisory agency (BRSA) and some economic ministries, were suspended or dismissed. Some 40,000 people were detained and over 4,000 companies and institutions with assets of nearly $4 billion have been closed, or taken over by the state.

The United Nations has reported that between July 2015 and December 2016, some 2,000 people were reportedly killed during security operations in southeastern Turkey. This included close to 800 members of the security forces, and approximately 1,200 local residents, of which an unspecified number may have been involved in violent or non-violent actions against the state. The number of displaced persons (IDPs) in southeastern Turkey is estimated to be between 355,000 to half a million people, mainly Turkish citizens of Kurdish origin. The displaced population is reported to have moved to neighboring suburbs, towns, and villages, or to other parts of the country. Another indication of the scale of the conflict was a government decision, announced in September 2016, to implement a reconstruction and economic development package for southeastern Turkey. According to the plan, Turkey would spend $21 billion in the regions “destroyed by the PKK since July 2015.” The Housing Development Administration plans to build or re-build more than 30,700 houses and to construct 800 factories, 36 sports stadiums, and 15 new hospitals.

While conflict in the south east of the country has been going on, Turkey faces another emergency. According to the United Nations High Commissioner for Refugees, in February 2017 there were 2.9 million Syrians in Turkey, about 10 percent of them living in the camps established along the border with Syria. The rest were dispersed throughout the country, including the more developed, western regions. The Syrians are young: more than half are below 18 years old and 20 percent below 11 years old. Those over 65 years account for only two percent.

According to the official Turkish sources, by the end of 2015, total government spending on Syrian immigrants exceeded $8 billion (1.1% of 2015 GDP). About five percent of this amount was co-financed with the international community. The March 2016 agreement between the EU and Turkey, which included a financial assistance package of €6 billion until 2018, will increase co-financing. At the same time, further spending is needed for education, health, and language training, which are essential for the integration and social inclusion of immigrants, and will continue to put pressure on Turkey’s public finances.

The integration of immigrants into the labor market is also problematic in the short term. Only 20 percent of Syrian immigrants have a secondary education or more. The estimated number of working age immigrants is approximately 1.4 million (equal to five percent of Turkey’s labor force) and their entry in the labor market will represent a major expansion in the lower-skilled end of the market. There is evidence that immigrants have replaced Turks in significant numbers in certain market segments, such as seasonal agricultural work, informal work, and the service sector. Turkish employees in border regions secure better paying, formal jobs due to increased spending by and for the immigrants. The opportunities for low-skilled immigrants to find jobs in the formal sector under existing employment rules and regulations (including the new minimum wage) are very limited, leading many immigrants to work in the informal sector.

The latest data show a downturn in the economy in the third quarter (July-September) of 2016 when GDP in real terms was 1.8 percent lower than in the third quarter of 2015. This compares with growth of six percent in 2015 and 4.5 percent in the first half of 2016. Agricultural production fell by 7.7 percent and had been weak in the first half of the year; industrial production decreased by 1.4 percent, of which manufacturing fell by 3.2 percent. Production growth in the construction sector slowed drastically from 15.7 percent in the third quarter to 1.4 percent in the third. The service sector, which is the biggest in the economy, suffered a fall of 8.4 percent in output in the third quarter. According to the IMF, domestic consumption has been the main source of growth together with a large increase in public expenditure and a rise in the minimum wage. Political uncertainty, lower corporate profitability, very slow credit growth, and a sharp fall in revenues from tourism have resulted in falling investment and exports. Unemployment rose from 3.1 million (10.3%) in November 2016 to 3.7 million (11.6%) in February 2017, on a seasonally adjusted basis. The youth unemployment rate rose from 18.3 percent to 21.3 percent during the same period.

The exchange rate of the Turkish lira has fallen by a third against the US dollar in the last year. Much of this occurred during the crisis following the attempted coup, and at the beginning of January 2017, in order to protect the value of the currency, the Central Bank of Turkey raised interest rates. This was done against the government's will and against the background of a weakening economy. The fall in the exchange rate also reflected anxiety about the balance of payments and Turkey's foreign debt.

Turkey has borrowed large sums abroad to finance the construction of public-private sector infrastructure projects worth some $140 billion. These have also become more expensive to finance in local currency because of the devaluation. The total debt of non-financial companies rose from nearly $32 billion in 2002 to $176 billion in 2010 and to $304 billion at the end of 2016. The net debt rose from $6.5 billion in 2002 to $89.4 billion in 2010 and to $201.5 billion at the end of 2016. Loans from abroad rose from $25. 7 billion in 2002 to $76.1 billion in 2010 and to $92.9 billion at the end of 2016.

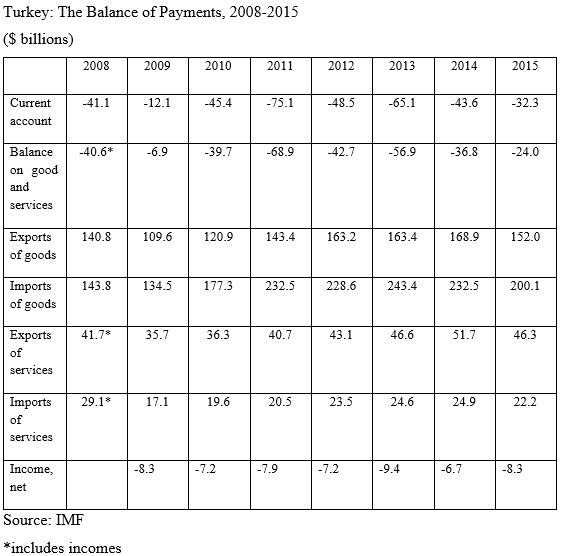

Table 1 shows the how the deficit on the current account of the balance of payments grew as a result of imports increasing faster than exports. This was largely due to the increase in the cost of oil imports. The deficit has been financed largely by borrowing.

Table 1: Turkey Balance of Payments

By 2015, Turkey had become one of the most popular tourist destinations in the world. Its share in the global inbound tourism increased from 1.5 percent in early 2000s to about three percent in 2015. During that period, the number of foreign tourists’ arrivals tripled and reached 36 million. In 2016, there was a change. The number of foreign tourists dropped sharply due to rising security concerns and travel restrictions resulting from Russian sanctions in force between the end of 2015 and June 2016. The number of terrorist incidents in Turkey increased dramatically during the last few years. According to the Global Terrorism Database, the total number of registered attacks exceeded 400 in 2015 (as compared to an average of 70 in 2010–2014), including at least 40 attacks in tourist areas. During 2016, the security level assigned to Ankara and Istanbul by the UN was raised to moderate from minimal/low a few years ago.

In January-September 2016, the number of tourist arrivals from Europe dropped by over 30 percent and from Russia by more than two-thirds. This contributed to about 30 percent drop in exports of transportation services, and had negative effects on other sectors. In 2015, travel services earned around $27 billion of export revenues (3.7 percent of GDP and about 13 percent of total export proceeds). In selected regions, it was one of the key employers. The tourism sector was estimated to directly generate over 600,000 jobs (2.3% of the total employment), with about two-thirds of jobs associated with foreign tourism. Additionally, approximately one million jobs were indirectly created by tourism.

Turkey's economic problems are deeper than recent events suggest. Although one of the main sources of economic growth has been the manufacturing industry, compared with other developing countries in the OECD, Turkish manufacturing has suffered from slower productivity growth, is less competitive, has done less well in international markets, and accounts for a smaller share of national output and employment. Real devaluation after the global financial crisis of 2008-2009 improved competitiveness, but this did not restore the position of Turkish manufacturing vis-a-vis comparable countries. Although exports have gradually diversified from agricultural products, textiles, and clothing to other sectors, such as road vehicles and electrical machinery, the share of high-technology products has remained very low.

In the decade to 2013 value added in the manufacturing sector increased by about 70 percent and employment rose by nearly 30 percent. The development of export-oriented manufacturing, not only in the traditional industrial west but also in the poorer regions of Anatolia, played a major role. Manufacturing jobs grew in all regions, albeit unevenly. Jobs were also created in the construction and services industries. In the economy generally, and in the lower-income regions in particular, job creation in manufacturing stimulated employment growth in other sectors.

As a result, an increasing share of the low-skilled majority of the population found employment in higher-quality occupations. Men and women with less than secondary education, who represent 65 percent of the working age population, were traditionally employed at the edge of the formal labor force. Low-educated women remained inactive in urban areas, or worked as unpaid family members in agriculture. Low-educated men were mostly self-employed in low-income jobs, or were hired by small businesses in the informal sector. Workers above age 45 had a low employment rate.

In recent years, these groups have started to participate more actively and to take jobs in the formal business sector. This has helped reduce the rate of extreme poverty from 13.3 percent in 2006 to 1.6 percent in 2014. The contribution of job creation to keeping income inequality in check contrasts with experience in other countries, where welfare payments played a more important role.

Very small and small to medium enterprises have grown faster since the 2000-2001 crisis and now account for nearly 50 percent of employment in manufacturing. According to the OECD, these firms expanded largely by circumventing Turkey’s regulatory framework, especially labor regulations and the tax system, which was designed for larger, higher productivity firms, proved ill suited. Most of these firms do not operate as financially transparent and fully law-abiding enterprises. As a result, the most dynamic and job-creating part of the industry has had to rely on the informal agreements with policymakers. In contrast, larger firms have remained subject to taxes and charges that policymakers have tried to offset with a complex set of incentives.

This has created a business environment excessively exposed to the discretion of public officials in charge of enforcing regulations. Such an environment is not conducive to increasing productivity. It subsidizes less productive firms, while sending mixed signals to the more productive ones. It hinders productivity growth within enterprises because as successful smaller firms may be deterred from growing in size and larger firms may refrain from absorbing a higher share of the labor force. This environment has discouraged foreign direct investment and Turkey's integration into the international economy.

While the import content of Turkey’s exports has increased, its capacity to provide intermediate inputs to other countries has remained limited. This partly reflects Turkey’s specialization in final products, but also suggests that there are obstacles in trade and investment policies, underdeveloped human capital, and a lack of investment in innovation, research and development and knowledge-based capital. The move to a more export-oriented economy based on a level playing field needs to be supported by social policies to ensure displaced workers can find productive employment.

In April 2017, there will be a referendum on constitutional reform. If approved, the new constitution will concentrate power in the hands of President Recep Tayyip Erdoğan, and he may be able to remain in power until 2029. Whether this kind of political system can provide the answer to Turkey's economic difficulties remains an open question.