Recently, two trends became apparent in global oil markets. First, prices rose: the OPEC basket price reached $73.14 a barrel on 24 April 2019, a 40 percent rise over the price at the beginning of January, and 13 percent higher than the average for the year of 2018. According to the International Energy Agency, the reasons for higher prices included tighter global supplies that have prevailed due to strong compliance with OPEC’s decision in December 2018 to reduce production by 1.2 million barrels a day (mb/d), as well as sanctions against Venezuela and Iran, and conflict in Libya. These developments, along with the second trend of the rising US share in the global oil market discussed below, offset bearish factors including concern over the health of the global economy.[1]

The US announcement it would not renew waivers on Iranian oil sales after 2 May 2019 has affected OPEC and Russia's strategy and will force Iran to cut output further. Iran’s crude oil production fell to 2.754 million barrels per day (mb/d) in January 2019, about 1.064 million barrels per day less than in May 2018, when the United States withdrew from the 2015 nuclear agreement. The January oil production level was the lowest level since October 2014, during the tightest period of the previous round of international sanctions (2012-2016), imposed on Iran’s oil exports.[2]

Iranian production in April was estimated at 2.8 mb/d. Iran typically refines around 1.7 mb/d, providing a secure outlet for the bulk of its current crude output. Exports may fall from recent levels of around 1.4 mb/d to below one mb/d, but this would still be sufficient to maintain production at around 2.5 mb/d. That was the low point reached in July 2012 during the previous round of sanctions. Iranian oil exports averaged more than 1.7 mb/d in March, including nearly 628,000 b/d sent to China and more than 357,000 b/d to India. China's response to tougher US oil sanctions on Iran will be crucial in determining how the international oil market develops in 2019, because it accounted for 40 percent of Iran's shipments in the first quarter of the year and has the ability to skirt sanctions without damaging its economy. India, which is Iran's second largest customer, accounting 23 percent of first quarter 2019 shipments – is likely to comply with US sanctions, according to some analysts. Japan and South Korea, which each accounted for 13 percent of Iran's first quarter exports, will almost certainly halt trading with Iran when their waivers expire. China will further reduce imports from Iran in a nod to US policy, but may continue buying Iranian crude in defiance of US sanctions. Trade talks between the US and China will include the issue of Beijing's compliance with Iran sanctions. The US could find a way to ease up on sanctions enforcement in exchange for concessions as part of a trade deal.[3] This would make any movement of oil to China part of an implicitly three-way deal.

The likely 300,000 b/d fall in Iranian exports would represent a considerable tightening of the international oil market. Furthermore, it will not be in isolation: Venezuelan output continues to slide amid its political crisis, and while Libyan production remains low as the conflict there intensifies. In addition to the deteriorating status of these three members of OPEC uncertainty has worsened in Algeria, where the transitional post-Bouteflika regime has replaced the CEO of Algeria's state oil firm, Sonatrach.

The most critical element of curtailed Iranian production would not be the impact on the overall supply-demand balance, but the removal of medium and heavy oil grades. The IEA warned last month that the tightening supply of medium and heavy sour crudes and high supply of light crudes have created a crude quality imbalance.

At the end of April, President Trump called for lower prices and this caused a dip. The sensitivity of the administration to an oil price of $73 a barrel remains despite the enormous improvement in the US energy balance. The Russian finance minister was quoted as saying that Russia and OPEC may decide to boost production to fight the US for market share. "There is a dilemma. What should we do with OPEC: should we lose the market, which is being occupied by the Americans, or quit the deal?" …referring to the 2016 deal between OPEC and Russia he said that if the deal is abandoned: "the oil prices will go down, then the new investments will shrink, American output will be lower, because the production cost for shale oil is higher than for traditional output."[4]

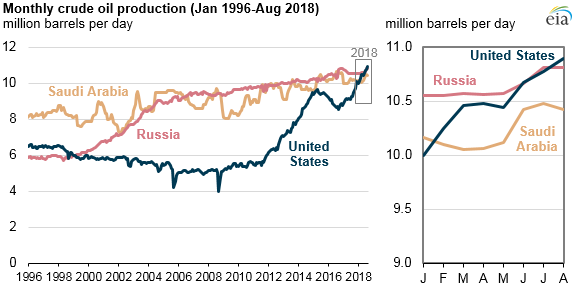

The second trend that emerged this spring was the increasing role of the United States in international energy markets. In 2018, the US became the world's largest crude oil producer, having gained the top spot for natural gas in 2009 and for petroleum hydrocarbons in 2013. The changes in the US position can be dated back to 2015.

In that year the US the lifted its ban on crude oil exports, the most dramatic change prompted by the shale revolution. The low oil prices that prevailed from mid-2014 focused attention on the need for an export outlet for US crude, and the move provided a market for rising production. As a result, US crude oil exports rose from 42,000 barrels a day in 2010 to two million barrels a day in 2018. US crude imports fell by 24 percent from their peak in 2005 3.7 mb/d to 2.8 mb/d in 2018.[5]

Since 2014, lower oil prices have pushed companies in the shale business to cut costs, increase efficiency, and increase productivity per well. It also drove some smaller players out of the market and led to consolidation. In a high-price environment, shale producers could throw money at a problem or a supplier, while the low-price environment forced them to wring efficiencies out of the process. As a result, US shale producers adjusted exploration and extraction techniques to weather the turmoil of low oil prices and Saudi oil-market policies prior to the Vienna agreement. While there were bankruptcies and job losses, healthier companies emerged.

The gains in oil production made possible by the rise of shale also influenced Saudi Arabia’s production policy. This was the key factor resulting in its decision late in 2014 to push for market share. The result was a global oil supply glut that Saudi Arabia would later push OPEC to correct, resulting in a historic agreement between OPEC and non-OPEC producers (primarily Russia) to limit production in late 2016. That agreement was renewed in December 2018.[6]

Table 1 shows how the US oil production has overtaken that of both Russia and Saudi Arabia. Unlike those countries, the US is not primarily a producer of hydro-carbons and so its reliance on that sector is much lower. In 2017, oil accounted for 77 percent of Saudi exports. Oil and gas accounted for 54 percent of Russian exports and only three percent of US exports.[7]

According to the International Energy Agency, the United States will account for the largest increase in oil supply in the next five years thanks to irrepressible growth in shale oil output. Among OPEC countries only Iraq and the United Arab Emirates are the producers will add significant new production capacity during the same period, though these gains will be offset by steep losses from Iran and Venezuela, due to sanctions and political and economic turmoil. The United States will add four mb/d of oil to its production capacity, accounting for 70 percent of the total increase in global oil supply to 2024. Total U.S. oil output will increase from 15.5 mb/d in 2018, to 19.6 mb/d by 2024.[8]

As a result of its strong production growth, the US will become a net oil exporter in 2021, as its crude and products exports exceed its imports. Toward the end of the forecast period (2014), U.S. gross exports will reach nine mb/d, overtaking those of Russia, and will be close to those of Saudi Arabia, the world’s largest oil exporter.

It is important to note that shale is gas as well as oil, because this has also had geo-political as well as economic implications. US gas production rose from 26.8 billion cubic feet (bcf) in 2010 to 37 bcf in 2018.[9]

Exports, by pipeline and of liquid natural gas (LNG) rose from 1.9 bcf to 3.6 bcf over the same period. The higher price for LNG in markets in Asia, Latin America, and Europe, compared to the low US Henry Hub price, provided a financial incentive and physical outlet for US gas, enabled by shale production.

These developments in the oil and gas sectors have transformed the US balance of payments, reducing bill for fuel imports and increasing revenues from fuel exports. This has, ironically, given the geo-political implications, enabled the United States to increase its imports from China. It has also given the US more freedom in its dealings with Middle East countries.[10]

Although it did not import a lot of oil from the region - in 2017, the Persian Gulf accounted for 17 percent of US oil imports - it was more reliant on oil imports than it is today. By contrast, the Gulf accounted for 26 percent of China's oil imports that year.[11]

The oil market is, as usual full of uncertainty about prices in the short term but the medium term looks more stable because of the success of US shale production. This will be encouraged by any future OPEC or OPEC + Russian attempts to push up prices. It seems from the evidence of recent years that it will not collapse if prices fall. This will provide the market with a significant element of stability in the medium term. It will also enable the United States to adopt a more relaxed or hands-off policy in the Middle East, as it will not be beholden to oil and gas producers there. This is a strategic advantage over China and other importers. It also has a strategic advantage over the other large producers such as Saudi Arabia and Russia in that it is much less reliant on oil exports than them for its overall economic success.

[1] International Energy Agency, “Oil Market Report,” April 11, 2019.

[2] Dalga Khatinoglu, “OPEC report shows Iran’s oil production and exports down in January,” Radio Farda, February 12, 2019.

[3] Brian Scheid and Meghan Gordon, “US to end Iran sanctions waivers in May; Iran threatens to close Strait of Hormuz,” S&P Global, April 22, 2019.

[4] BBC News, “Oil Prices Down,” April 15, 2019.

[5] US Energy Information Agency, data.

[6] Ellen Scholl, “The Future of Shale: The US Story and Its Implication,” The Atlantic Council, January 8, 2019.

[7] IMF Staff Country Reports, “Saudi Arabia: 2018 Article IV Consultation,” No. 18/263, August 2018; and “Russian Federation: Article IV consultation,” No. 18/275, September 2018. Daniel Workman, “Crude Oil Exports by Country,” World’s Top Exports, April 22, 2019; and “Petroleum Gas Exports by Country,” April 3, 2019.

[9] EIA Natural Gas data, “US Natural Gas Gross Withdrawals” from 1940 to the present.

[10] Binyamin Appelbaum and Jim Tankersley, “US Oil Exports are Rising. So is the Trade Deficit.” New York Times, December 6, 2018.

[11] Daniel Workman, “Top 15 Crude Oil Suppliers to China,” World’s Top Exports, April 12, 2019.