In the aftermath of the Arab Spring, the six members of the Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates – increased public expenditure to counter the threats that the Arab Spring posed to internal security and to mitigate threats from Iran and the Islamic State. Between 2012 and 2014 oil revenues were buoyant as a result of high oil prices, and this made it easy to make these allocations. In 2014, however, the international price of oil collapsed, and this created serious financial problems. There may be a silver lining in the cloud, if the fall in oil revenues prompts reforms that have long been advocated in the region.

The GCC countries are among the richest in the world largely because of their huge oil and gas reserves. In 2015, the GCC possessed 29 percent of the world's oil reserves and was responsible for 23 percent of world production. According to OPEC, GCC states earned $671 billion from oil exports in 2015 and in the years 2005-2015 they earned $6.9 trillion. In 2015, their population was about 51 million (of whom about 20 million were foreign workers) and oil export income per capita came to over $13,000. Between 2012 and 2015, however, GCC oil export revenues fell by about 50 percent despite a rise in production of almost five percent. The US Energy Information Agency forecasts a 16 percent fall in OPEC oil revenues in 2016. The GCC accounted for 28 percent of OPEC revenues and 50 percent of production in 2015.

As the "Arab Spring" protests spread to Oman, Saudi Arabia, and especially Bahrain, all six GCC governments embarked on very expansive programs of social spending designed to stamp out the economic sources of discontent. Gulf leaders offered direct payments to families, inflation allowances, and more public sector jobs. In 2011 and 2012, Saudi Arabia allocated more than $100 billion to new welfare initiatives. In September 2011, Qatar, although unaffected by the protests, preemptively raised the salaries of nationals working in the public sector by 60 percent and by 120 percent for the police and the military. Gulf rulers felt vulnerable to the regional wave of popular unrest, but historically high oil prices enabled them to respond vigorously.

Five years later, this dynamic has been reversed. The spread of post-revolutionary violence and civil wars across North Africa, Iraq, Syria, and Yemen, enabled the GCC states to reemerge as an island of stability in the midst of regional chaos, and it is now GCC nationals rather than governments who feel most threatened.

As witnesses to the horrors broadcast daily from Iraq, Syria, Libya, and Yemen, and elsewhere, and as the victims of terrorist bombings carried out by Islamist militants in Kuwait, Saudi Arabia, and Bahrain, many GCC citizens have come to value stability as a political end in itself. In Qatar, for example, in 2011, 37 percent of citizens identified maintaining order and stability as their top priority; by 2014, this proportion had doubled to 75 percent and this was in a country where nothing had happened.

Even more important than private financial benefits conferred by the rentier state was the public good of security and social order that is today the main source of legitimacy for the rulers of the Gulf. A new kind of political bargain has emerged: Gulf populations have until now traded political involvement in exchange for a cradle-to-grave welfare state. The current regional turmoil has encouraged the citizens of the GCC states to accept their unelected rulers in exchange for protection and stability.

This mechanism has eased the trade-offs that the leaderships have had to make between reducing instability within the country by reallocating resources and the fact that they have less money. The internal threats to stability seem to have eased because the external environment has deteriorated so much. Iran, now freed, or partly freed, from international sanctions has become a bigger threat to the GCC than ever before.

The GCC states have identified their economic structure as a source of instability. Oil revenues have fallen and they may not rise significantly in the short or medium term. The consensus that is emerging in oil markets is that oil prices will not go up to anything like what they were in the past. A couple of years ago, international forecasting organizations were talking about oil prices reaching $200 per barrel and the world economy being able to buy oil at that price. That is no longer true.

A recent IMF report on the GCC states concluded that the discovery of oil in the region was a mixed blessing. Oil revenues provided an opportunity to develop the economy and improve standards of living. They also facilitated large investments that were made in infrastructure and heavy industries, and led to developing services such as finance, logistics, trade, and tourism, and allowed for spending on health and education, and affordable food and energy for the population. The decline in oil prices in the 1980s and 1990s did not pave the way for export diversification, and the GCC economies remained as dependent on oil as in the past. In 2014, the oil sector directly accounted for 42 percent of GDP in the GCC. The problem is that the oil sector does not provide much employment. Yet it has made the rentier state, allowing the government to use oil revenues to provide public sector jobs and subsidies to citizens.

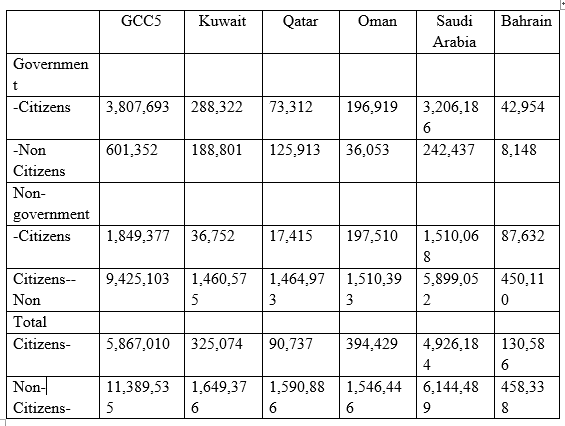

The result of the rentier system has been low and falling labor productivity – how much is produced per person or per man hour – is a key measure of the health of the economy. Oil wealth has been used to create a very inefficient economic system, despite tremendous construction and physical growth, disposable wealth, and apparent dynamism. These economies are still reliant on imports of raw materials, manufactured goods, and labor. At the same time there is large-scale youth unemployment especially among Saudi citizens as well as reliance on the public sector for the employment of nationals (See Table 1).

Table 1: Employment of Citizens and Non-Citizens by Sector in Five GCC States, 2014*

Table 1 shows that the foreign labor force is almost twice as large as the national (citizen) labor force. Over 60 percent of the national labor force was employed in the government sector while over 80 percent of the foreign work force was in the private sector. One of the main features of these economies was that the more productive or diversified private sector mainly employed foreign workers.

The fall in oil prices since 2014 resulted in changes in economic policy. In Kuwait, government revenues fell sharply and the foreign trade balance also deteriorated. In August 2016, it was reported that lower oil prices have caused a budget deficit, after 16 years of surpluses. The budget deficit was $15.3 billion in the fiscal year that ended on March 31, 2016, and Kuwait is projecting a deficit of $28.9 billion in the fiscal year that began on April 1, 2016. Revenues were down by 45 percent to $45.2 billion, while spending was cut by 14.8 percent to $60.5 billion. Oil income was $40.1 billion, a fall of 46.3 percent from the previous year, and it accounted for 89 percent of total revenues, down from 95 percent in previous years.

Kuwait plans to finance the deficit by tapping international markets through bond issues. The finance minister has said that Kuwait would borrow up to $10 billion in US-denominated bonds from international markets, using both conventional and Islamic financial instruments and will also borrow $6.6 billion from the domestic market. Kuwait has a sovereign wealth fund worth around $600 billion that is mostly invested in the United States, Europe, and Asia.

As part of its efforts to reduce the budget deficit, the government recently decided to reduce subsidies and raise the domestic price of petrol by up to 83 percent, the first increase in almost two decades. Last year, it raised the prices of diesel and kerosene. It has also decided to increase electricity and water charges for foreign residents.

In Oman, the state-owned petroleum industry has borrowed $4 billion abroad to finance its development because the government can no longer provide funding. Even Bahrain, beset by severe political problems and lacking large-scale oil resources, has been able to borrow over $1 billion this year.

In Qatar, the government has cut the GDP growth forecasts for 2016-18 and raised the budget deficit forecast for these three years. Real GDP is forecast to rise by 3.9 percent in 2016, compared with a December 2015 projection of 4.3 percent. The projected 2016 budget will be in deficit for the first time in 15 years, at 7.8 percent of GDP. This compared with a surplus equal to 3.5 percent of GDP in 2015. Qatar has borrowed $9 billion abroad so far this year, including long-term bonds. It has a sovereign wealth fund with assets worth $256 billion in June 2016.

The UAE economy is experiencing a slowdown in economic growth as a result of low oil prices. The growth rate has fallen from an average of six percent in recent years to 4.6 percent in 2015 and a projected 3.4 percent in 2016.

The fiscal balance and balance of payments have worsened because of the fall of hydrocarbon revenues coupled with expansionary fiscal policy. The fiscal balance fell from a surplus of 10.4 percent of GDP in 2013 to a 5 percent surplus in 2014, and to an estimated deficit of 4.3 percent of GDP in 2015. The fiscal deficit of 2015 was the first since the financial crisis of 2009, when the real estate bubble in Dubai burst. The severity of change is apparent in the current account, where surplus fell from 18.4 percent of GDP in 2013 to 13.7 percent of GDP in 2014 and to only 0.2 percent of GDP in 2015.

The UAE government, along with other GCC countries, is considering introducing a value added tax and corporate taxes. This would help improve the fiscal balance. The World Bank has warned that other consolidation measures are needed, including a reduction in electricity and water subsidies and a gradual slowdown in the implementation of massive investment projects by government related entities.

The main sources of medium-term risk are associated with the financial management of megaprojects in Dubai. In an environment of low oil prices, macro-financial risks could be exacerbated by declining liquidity in the banking system, increased volatility in the stock markets, and disruptive declines in the real estate sector.

The GCC states have all recognized the dangers of their reliance on oil and the state to finance and develop their economies. They have all issued "vision" programs detailing how they plan to solve these problems by diversifying their economies. The most dramatic plan was announced by Saudi Arabia earlier this year. (See: Andrea Helfant and Paul Rivlin, "Saudi Arabia's Plans for Change: Are they feasible?," Iqtisadi, May 2016.)

Eight years ago, Abu Dhabi preceded Saudi Arabia and issued proposals for reforms but little was actually done. It is now very easy to borrow on international markets for anyone with collateral because interest rates are so low and international economic conditions mean that there is a dearth of investment opportunities. Along with some reforms, such as tax increases and subsidy cuts, the GCC is borrowing its way out of the fiscal and balance of payments problem and thus delays the need for change. It remains to be seen whether the temptation of relying solely on oil rent, even at currently low prices, again prevents or delays major reforms in the GCC states.